Start ICHRA Here

End-to-end ICHRA strategy, compliance, and personalized benefits enrollment—built for employers who want control, flexibility, and certainty.

The ICHRA Shop helps employers replace traditional group health plans with a smarter model—without the compliance risk, administrative burden, or employee confusion.

We combine executive-level strategy, deep regulatory expertise, and human-first enrollment support to make ICHRA work in the real world.

Request an ICHRA Quote

ICHRA RFP & Procurement Support | Public & Private Bids

We partner with brokers, consultants, and CPA firms to simplify ICHRA vendor selection and reduce the time required to shop, compare, and implement ICHRA solutions for their clients.

ICHRA RFP & Procurement Support | Public & Private Bids

The ICHRA Shop partners with public entities, consultants, brokers, and advisors to evaluate, propose, and implement compliant Individual Coverage Health Reimbursement Arrangements (ICHRAs) through formal procurement processes, including RFPs, RFQs, and competitive bids. We provide independent analysis for the top ICHRA vendors across the nation.

Since 2020, we have supported hundreds of employers—many with large, distributed, and highly regulated workforces—by delivering end-to-end ICHRA consulting, enrollment, and compliance services. Our experience, documentation readiness, and structured approach make us a strong partner for public-sector benefit strategies and competitive procurement environments.

We work collaboratively with procurement officers, consultants, brokers, and CPAs to ensure proposals are accurate and aligned with bid specifications. Additionally, we provide proposal support, technical expertise, and implementation services that help advisors confidently include ICHRA as part of a competitive public-sector benefits strategy.

If your organization, client, or issuing authority is evaluating ICHRA through a formal bid process, we’re ready to support your RFP.

Data Needed for an ICHRA Quote & Feasibility Analysis

To prepare an accurate ICHRA Feasibility Analysis, we kindly request the following information. All data is handled securely and used solely for analysis.

- Employee census: name, date of birth, home ZIP code, employment status/class, coverage tier

- Current benefits: plan designs, current rates, renewal rates

- Budget: employer contribution strategy or total benefits budget

- Timing: desired effective or renewal date

Turnaround Time

Your ICHRA Feasibility Analysis is delivered within 3–7 business days and includes cost modeling, a compliance review, and vendor comparisons from top-rated ICHRA administrators.

Expert ICHRA Consulting for Employers

Independent Consulting that Simplifies ICHRA Selection

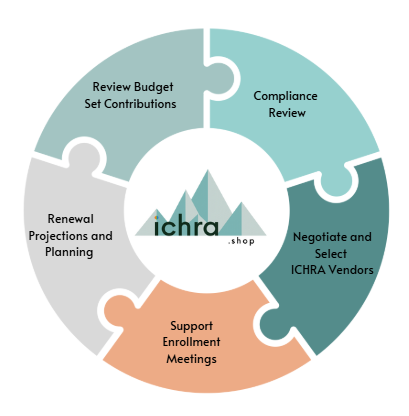

ICHRA Shop Consulting Services

We help enterprise employers manage benefits complexity, control long-term costs, and maintain compliance through a disciplined, data-driven approach.

ICHRA Feasibility & Affordability Analysis

Multi-year financial modeling, ACA Safe Harbor testing, contribution strategy, and transition cost analysis.

Executive Benefits Dashboard

Customized open enrollment reporting, workforce engagement reporting

Compliance Guidance & Documentation

Full ICHRA and ACA compliance support, ERISA plan documents, COBRA, FMLA, HIPAA, PCORI, ACA reporting, and Form 5500 preparation.

Financial Modeling, Analytics & Benchmarking

Employer contribution benchmarking, affordability stress testing, custom reporting, and industry comparisons.

Personalized Employee Enrollment

1:1 licensed consultations, personalized plan matching, enrollment support, and ongoing member assistance.

Carrier, Claims & Market Expertise

Network and formulary analysis, off-exchange plan expertise, carrier comparisons, and issue escalation.

Claims Analysis & Carve-Out Strategies

Identify coverage gaps, assess care disruptions, and design hybrid ICHRA and traditional benefit strategies.

Technology & Third-Party Vendor Analysis

Independent evaluation of ICHRA platforms and carriers, annual vendor scoring, and implementation support.

Broker & Partner Support

Co-branded enrollment services, broker enablement, escalation support, and national scalability.

Renewal, Optimization & Ongoing Advisory

Annual market reviews, contribution adjustments, regulatory updates, and executive renewal briefings.

Communications & Change Management

Employer and employee education, open enrollment communications, FAQs, and adoption support.

Since 2020, The ICHRA Shop has worked directly with the leading ICHRA vendors across hundreds of employer implementations.

We evaluate platforms based on real-world performance, not sales decks—so you get faster analysis, more thoughtful recommendations, and preferred pricing.

- Send us an RFP

- 30-minute strategy call

- Review Cost Analysis

- Consulting + Enrollment Support

Save time, one expert partner. access the best ICHRA platforms. Zero wasted time.

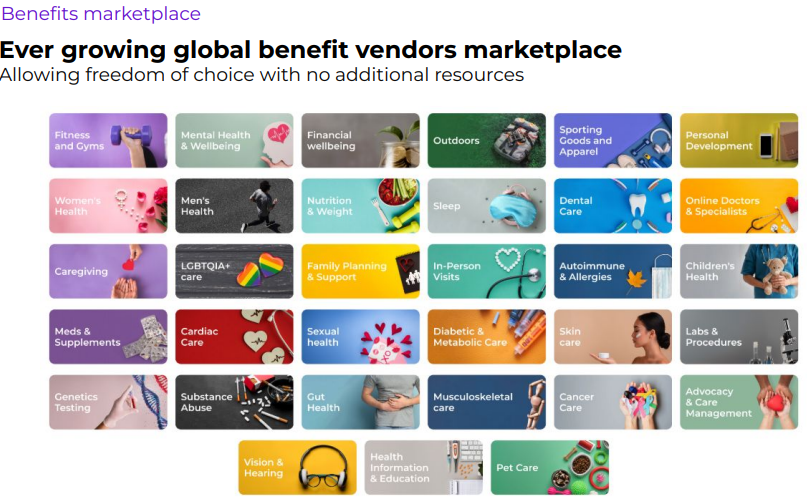

Choice Benefits

Choice Benefits™ — Unified Benefits. Smarter Payments.

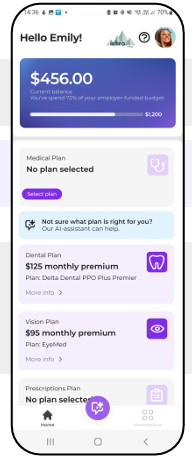

The Smartest Way to Deliver ICHRA

The only ICHRA solution that combines health coverage with a complete benefits marketplace—available exclusively through The ICHRA Shop.

Choice Benefits™, powered by The ICHRA Shop, unifies ICHRA and 500+ employee benefits into one seamless experience.

Through our exclusive platform partnership, employers gain a best-in-class shopping and payments experience—without vendor sprawl, manual reimbursements, or administrative burden.

Choice Benefits™ Pricing

$15 per enrolled employee/month

Common Questions

How do I refer a client to The ICHRA Shop?

We welcome referrals from brokers, consultants, PEOs, private equity firms, and CPAs—for enterprise or small-group clients.

Submit a referral via our website: ichra.shop/requestforproposal or call us at 303-903-2054. We’ll connect your client with the right ICHRA solution and provide full, fee-based support.

What is an ICHRA?

ICHRA (pronounced "ick-rah")

The Individual Coverage Health Reimbursement Arrangement (ICHRA) lets employers provide tax-free contributions for employees to buy their own health insurance.

Employees get freedom and choice, selecting the plan that fits their needs, location, and budget—while employers control costs, reduce claims risk, and simplify benefits administration.

Can I keep my broker?

The ICHRA Shop works with most brokers and consultants—simply request a proposal or have your broker submit an inquiry.

We primarily work directly with employers and are referral-only, ensuring personalized, expert guidance every step of the way.

What about CHOICE Arrangements?

CHOICE Arrangements are proposed updates to ICHRA that would codify the model in federal law, add flexibility, and provide incentives like pre-tax premium deductions and small business credits.

They aim to simplify adoption, clarify rules, and encourage wider use—operating much like ICHRA but with enhanced options for employers and employees.

Note: CHOICE Arrangements are still proposed legislation; ICHRA remains the active, regulated framework today.

What is the difference between CHOICE Arrangements and Choice Benefits?

Choice Benefits™ – ICHRA and More, All in One Platform

Choice Benefits™ combines the flexibility of ICHRA (proposed as CHOICE Arrangements) with a full benefits marketplace, giving employees access to medical, dental, vision, telehealth, Direct Primary Care, wellness, lifestyle, and supplemental benefits—all on one platform and one app.

Employers set contributions once, and employees enjoy freedom, choice, and easy management, while employers get visibility, compliance support, and streamlined administration.

Who are your investors?

While many ICHRA platforms are private equity owned, The ICHRA Shop remains independently owned and privately funded.

The ICHRA Shop has remained independently owned and privately funded since 2020, consistently delivering against revenue and growth targets, and scaling into one of the largest ICHRA platforms with exceptional revenue efficiency.